Gannett's central role in the death of local journalism jobs

We always knew Wall Street was bad news for local news. Here are some hard numbers.

Being a journalism labor leader in 2024 consists of many wonderful personal enrichment activities, and one includes maintaining an non-exhaustive mental list of executives and investors who should be drummed out of the journalism industry for the good of humanity.

So it was with great interest this morning that I read some fresh labor commentary from one of my favorite people to think about, Gannett CEO and one-man layoff factory Mike Reed, who isn’t a journalist but may have fired more of them than any other human being who has ever lived.

When asked about the nationwide rebellion of NewsGuild-represented journalists at the company he runs, Reed reportedly said that “the Guild, unfortunately, plays dirty and lies to our employees”

Reports Sara Fischer of Axios:

Asked to clarify ways in which the union lied, Reed said the Guild told employees that the company is using profits to buy back shares of stock and that the company is only cutting jobs to increase profitability.

In 2022, a Guild release inaccurately described the company's authorization to buy back shares as a repurchase of the shares, a Guild spokesperson said, but soon after corrected the error.

Reed also accused the Guild of lying about the company cutting jobs "to increase profitability," He said that's not true — "they're designed to keep a newsroom in the market itself," he said.

First off: Unlike Mike Reed, I’m a journalist. If my beloved union of journalists said something inaccurate about the way Gannett screamed from the rooftops about its share-repurchasing intentions in 2022 while paying my colleagues poverty wages and prodigiously breaking federal labor law after they asked for raises, I’m glad we corrected the record promptly.

But since Mike Reed has questioned the Guild’s accuracy, I think it’s only fair to point everyone back to Gannett’s own words about who benefits at Gannett when Mike Reed runs things.

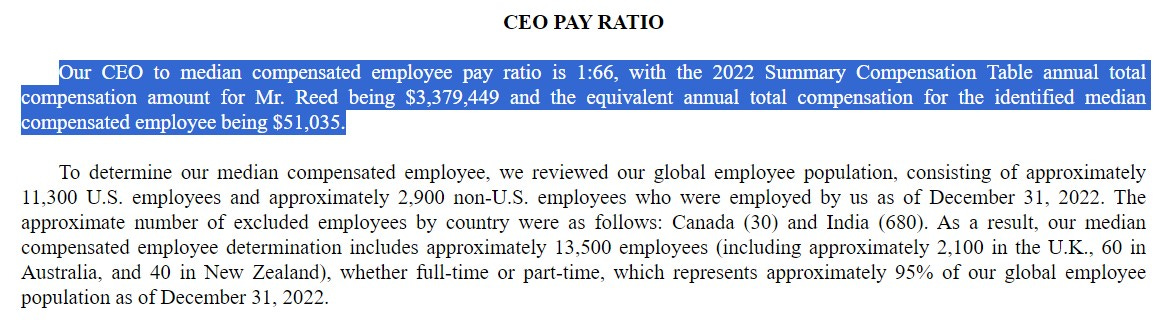

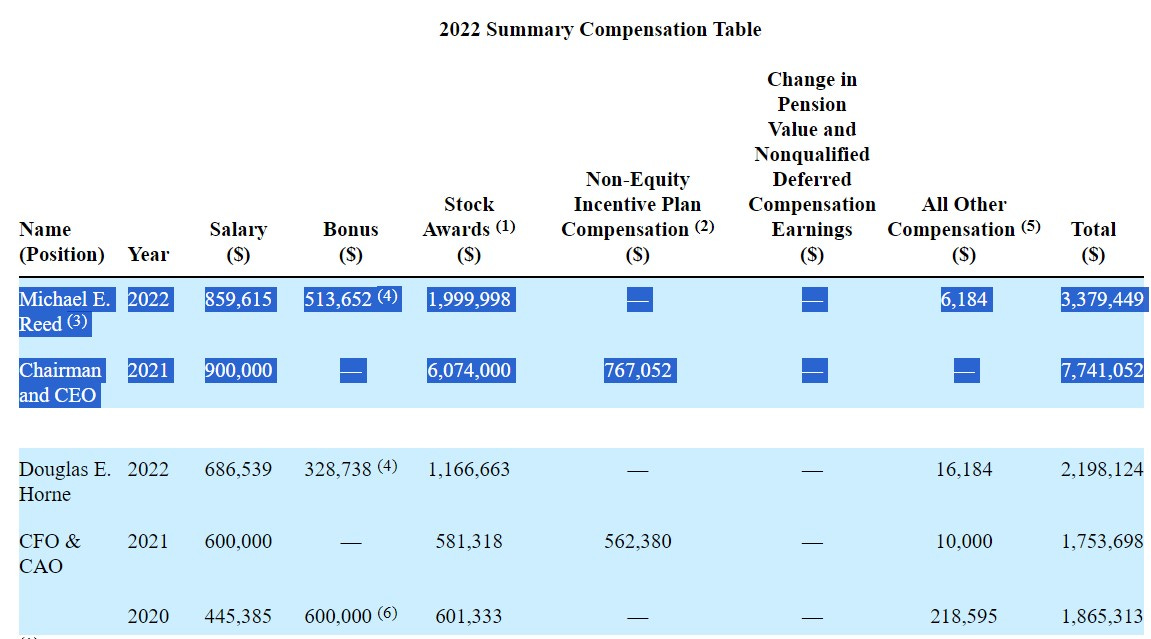

I turn now to one of my all-time favorite corporate transparency records, the Securities and Exchange Commission Form DEF 14A, a true friend to journalists everywhere. Here is what Gannett disclosed in its most recent such filing in April 2023:

“Now Matt,” you might be leaping from your chair to say, “Mike Reed runs a very big and complicated news company. If you don’t provide appropriate compensation to attract talented executives, you might get somebody who isn’t so good at the job. Then everybody suffers. And besides: Mike doesn’t work for journalists — he has a fiduciary duty to Gannett’s investors.”

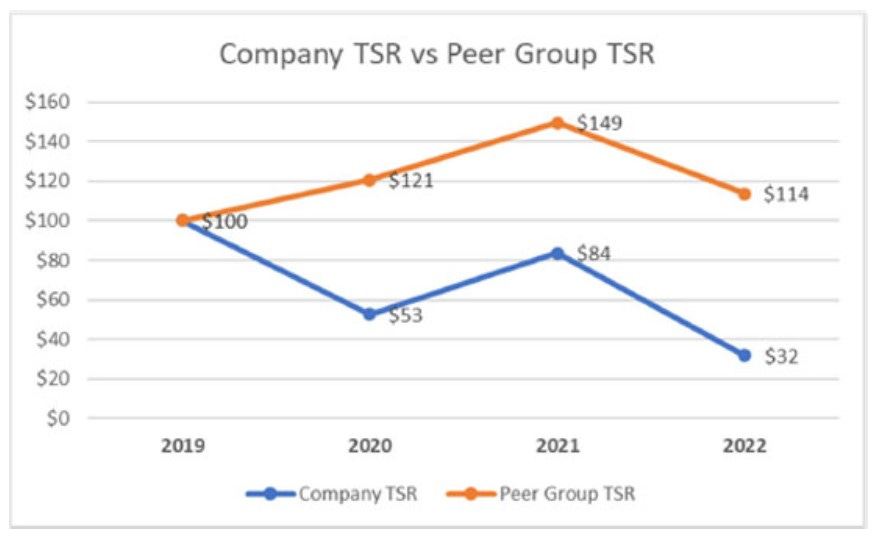

That is such a great point. Let’s see what Gannett reported in this same disclosure about how Gannett’s total shareholder returns have been faring under Reed’s leadership relative to his peer companies:

Ah, damn, that can’t be right. Maybe it’s some kind of funky glitch with the SEC requirements that forces Gannett to make it look like Mike Reed’s performance as one of America’s most important employers of journalists has been a huge disaster.

Enough of this frilly regulatory stuff. Let’s check the performance of the stock under Mike’s — ah, damn:

Okay, well, who cares about the shareholders? Sometimes losing a bunch of money to fund local journalism jobs in exchange for a bunch of positive social externalities is one of the best returns on society’s buck.

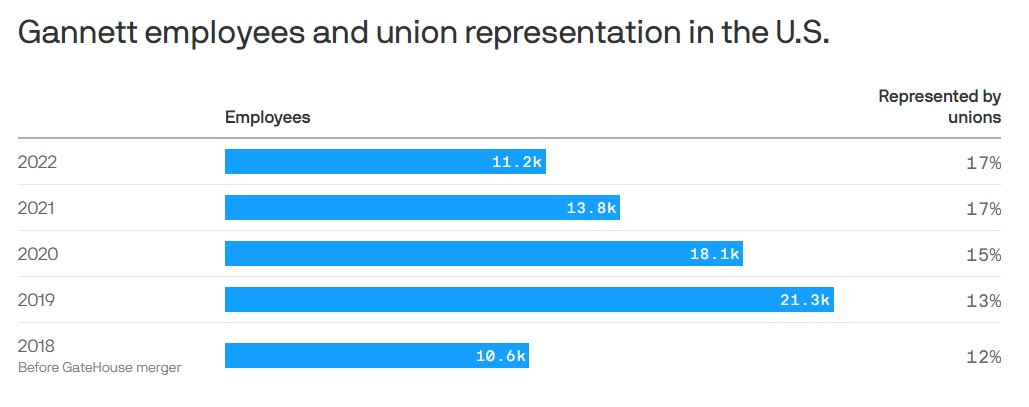

Maybe Mike Reed has been heroically scorning investors to provide public goods better than ever before — ah, damn, he made the equivalent of an entire-other-company’s-amount-of-journalism-jobs disappear:

The bigger picture for journalists and local journalism

To be serious for a moment: Those of you who have talked to me or seen me tech-punching over the past year or so know that I have come to the firm conclusion that even large news companies like Gannett are fighting forces much vaster than they are, and real-life journalists have been suffering for it.

That’s how journalism labor ends up on the same side of the table of the media corporations we often despise for bills like the California Journalism Preservation Act, which asserts that massive tech platforms have been profiting massively from the labor of journalists like me without paying for it or ever needing to deal with any one of our increasingly numerous picket lines.

Nonetheless, when incompetent and underperforming union-busters like Mike Reed wants to use his own journalists’ credibility to stick his hand out to Congress while publicly yapping about how his employees were too mean to him two years ago, it becomes incumbent upon me to remind everyone that Wall Street executives like Reed have also been a uniquely malignant force impeding the continued provision of local journalism to our communities.

New research from The Annals of the American Academy of Political and Social Science (originally published in 2023, but newly available online) provides one of those lovely empirically validating experiences that’s summed up right in the title: The New News Barons: Investment Ownership Reduces Newspaper Reporting Capacity.

Gannett plays a starring role:

[I]nvestment owners are distinguished from others by their stated emphasis on maximizing profits without an accompanying commitment to journalism and the communities they are located in. They are also distinctive in holding newspapers as a small part of a larger portfolio of nonmedia enterprises.

There are several major chains that fit this definition. Most prominent is “New Gannett,” the largest newspaper chain in the country, which formed when Gannett merged with GateHouse, a chain operated by the private equity Fortress Investment Group. Beginning in 2005, GateHouse was classified as investment owned and experienced steady growth; with the acquisition of Gannett, it saw a large increase in size. … The growth of investment media ownership is largely due to the rapid expansion of the chains operated by investment owners, particularly GateHouse Media’s 2019 merger with Gannett.

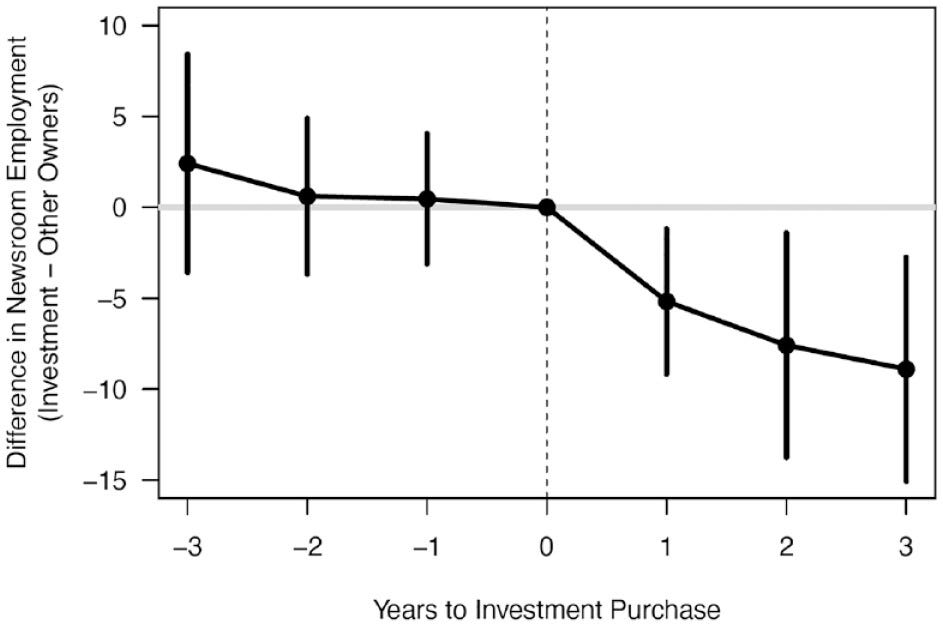

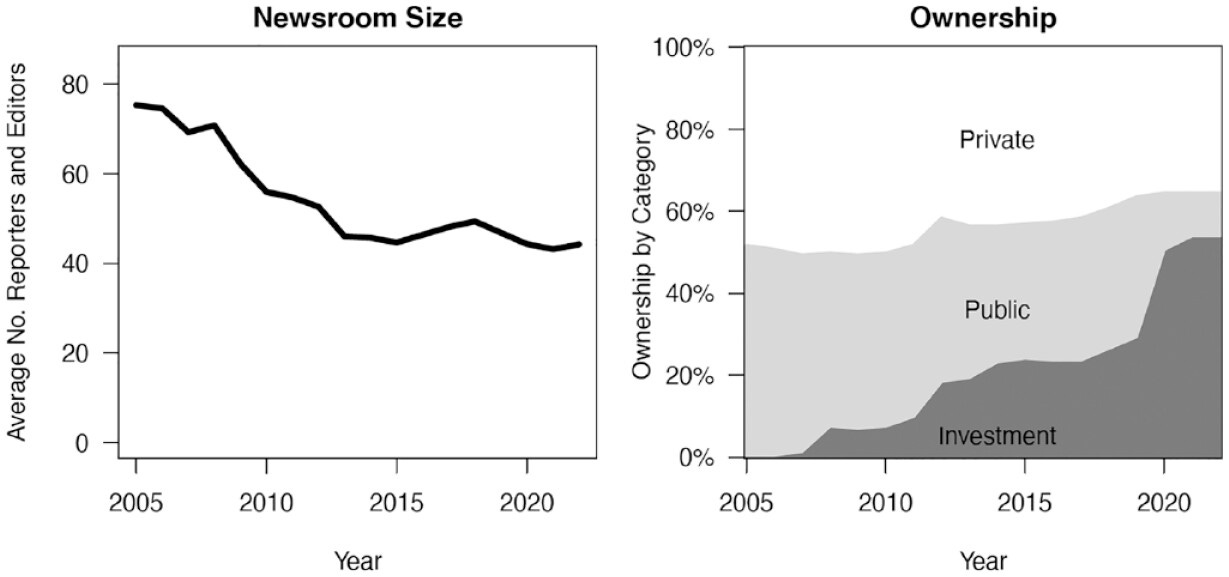

The story told by Erik Peterson and Johanna Dunaway’s research is this: When private equity comes to town, newsroom headcounts go down faster than they would under other types of ownership. They also tend to cut hard news jobs like political and general-assignment reporters first.

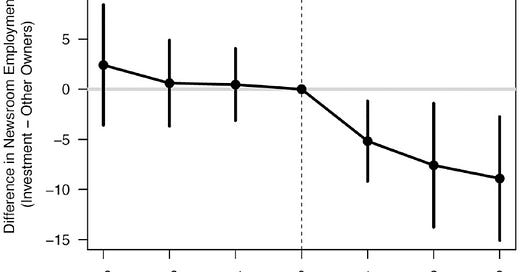

The chart at the top of this post compares newsroom headcount trends for newspapers newly acquired by investment owners (private equity, hedge funds and owners with investment backgrounds).

In 2005, U.S. local newsroom ownership was pretty evenly split between private owners (families and other locally based investors) and public owners (publicly traded companies).

At the time, in anti-commercial criticism that now feels almost quaint, it was the publicly traded news companies that faced attacks for prioritizing profits over quality journalism.

Now, those lumbering publicly traded firms plagued with plummeting market caps and the occasional bankruptcy have been replaced by even more rapacious asset managers, as indicated on the right side of the chart below.

Obviously, news outlets of all kinds, commercial and nonprofit, are in trouble. But this data shows Wall Street firms cut harder and faster than other types of owners, and Mike Reed gets irritated when his own journalists point these facts out. That’s why every Gannett newsroom needs a union, and increasingly has one.